Step-by-Step Integration Process

To begin the integration process, please refer to the detailed step-by-step instructions provided here.

To use SIGN ES, the following information will be needed:

- For the taxpayer obliged to TicketBAI or Verifactu regulations:

- Legal name

- Spanish tax number (NIF)

- Territory

- Address

- Additionally information of the representative for companies

- The content of the invoice document, including:

- the detail of line items for all transactions, including VAT rates, quantity and price.

- the recipient information (legal name, Spanish or International identification number and address) for B2B or enriched B2C transactions

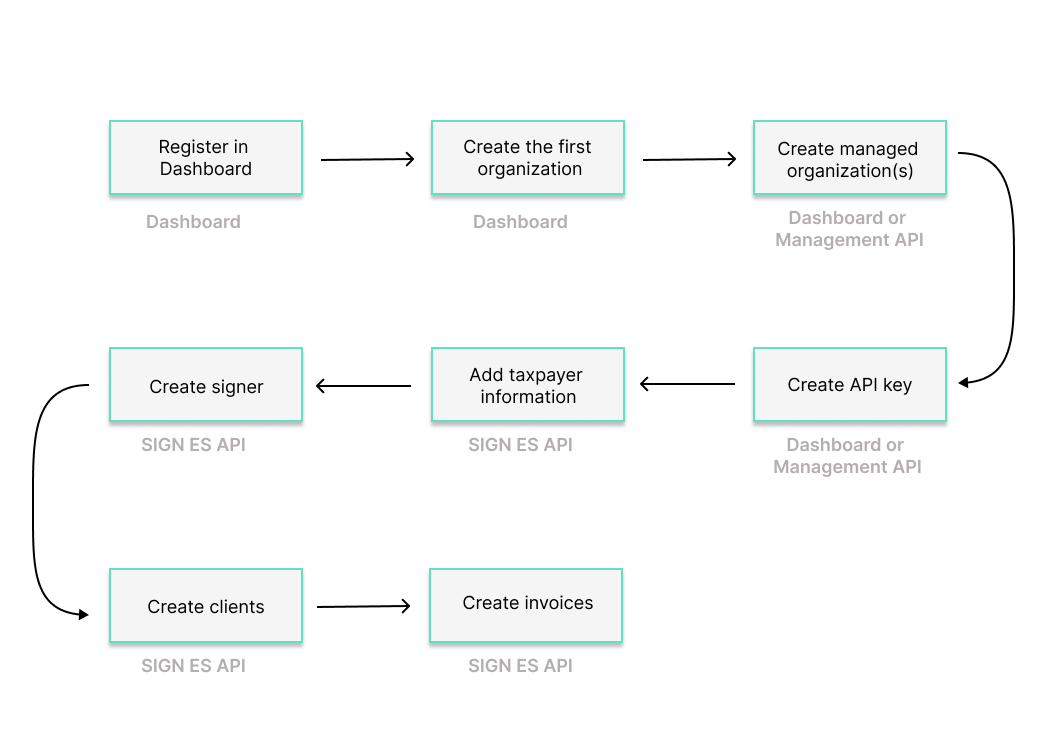

The accompanying diagram illustrates the workflow and highlights the essential steps necessary to successfully complete your integration.

For the integration, you will need to utilize our Dashboard, Management API, and SIGN ES API. The diagram below outlines the specific tools you will use for each step of the process.

Step 1: Registration

Begin by registering on the Dashboard. Creating an account is the first step, after which you can proceed with setting up the organizational structure for your business within our system.

Step 2: Creating your first organization

Continue with creating your first organization using the Dashboard. This organization will represent the POS provider or retailer with its own POS system. It is necessary to include the billing address at this stage. This address will only be used for fiskaly's billing purposes.

Step 3: Managed organizations

After establishing your first organization, you will proceed to create managed organizations. Each managed organization represents a merchant, enabling you to manage them separately. If you are considering to automatize your process, we recommend using the createOrganization endpoint of the Management API.

Step 4: API key generation

The next step is to generate an API key within each managed organization. This can be done via the Dashboard or the createApiKey endpoint of the Management API. This API key and secret pair is required for generating an access token, which is used for all subsequent API calls.

Note that API keys generated in TEST environment will create TEST resources, while those from the LIVE environment will create LIVE resources. For further details, refer to our article on Test and LIVE environment.

Starting from the next step, you will be utilizing our SIGN ES API. You may download our Postman collection for SIGN ES, which could facilitate your integration moving forward with the next steps.

Step 5: Taxpayer information

After authenticating with the previously generated API key and secret pair, you must add the taxpayer's information to the system via the createTaxpayer endpoint of the SIGN ES API.

Please make sure that the territory field is properly indicated according to the legal address of the taxpayer. SIGN ES API will apply the corresponding legislation based on this:

- Verifactu for

SPAIN_OTHER(Mainland Spain),CANARY_ISLANDS,CEUTAandMELILLA - TicketBAI for

ARABA,BIZKAIAandGIPUZKOA - Currently no fiscal regulation is applicable to

NAVARRE

This is a compliance step to ensure that all invoices generated are in line with tax regulations and contain all the necessary taxpayer details.

Step 6: Signer creation

Moving forward, you need to create a Signer via the createSigner endpoint for each managed organization. The signer is responsible for the electronic signature of the invoices.

Each signing device requires a certificate:

- For Verifactu compliance, a fiskaly-managed electronic certificate is automatically allocated during the creation of a Signer. fiskaly is registered as a social collaborator with the AEAT for Verifactu, for which the taxpayer needs to sign a social collaboration agreement with fiskaly. Find more information in the section Social Collaboration.

- For TicketBAI compliance, a device certificate is automatically allocated during the creation of a Signer, unless you want to provide your own external device certificate. This certificate can be retrieved from the API call response. If your customers are located in the Basque Country, ensure to send them the registration guide we provide from fiskaly. This will help them to correctly register the device certificates with the corresponding tax authority.

Step 7: Creation of Clients

The workflow includes creating Clients via the createClient endpoint. You should create a Client for each POS device or any other invoicing device used within your organization.

Step 8: Invoice creation

With all the previous steps completed, you are now ready to create invoices. This is the final step where invoices are generated and signed. SIGN ES ensures that all invoices are compliant with TicketBAI in the Basque Country and with Verifactu in the rest of the Spanish territory. The compliant information is provided in the successful response of the invoice creation process.

Please refer to the invoicing regulations in Spain for additional information about invoice creation.

For compliance with Verifactu, please make sure that a valid social collaboration agreement is signed by the taxpayer before starting issuing invoices. Find more information in the section Social Collaboration.