Introduction

Hey there!

Welcome to fiskaly's developer documentation! On this page we try to guide you through some of the technical and legal necessities which you need to be familiar with, in order to be compliant with the KassenSichV.

ERS/PoS Vendors, operators and taxpayers are now required to meet the KassenSichV regulations. This means that an electronic recording system (ERS), a Point-of-Sale (PoS) software, must have integrated a certain set of processes and reporting which ensure that cash and card transactions are correctly recorded and protected against manipulation.

Your ERS system must contain a technical security system (TSS), which cryptographically signs all relevant business transactions and their relevant VAT information.

The ERS and TSS together record each transaction. This way all records are maintained in an immutable, tamper-proof and auditable state for the financial authorities in Germany.

The fiskaly Cloud-TSS is the first TSS of its kind to have achieved the full certification until 2029. Details may be found on the certification page.

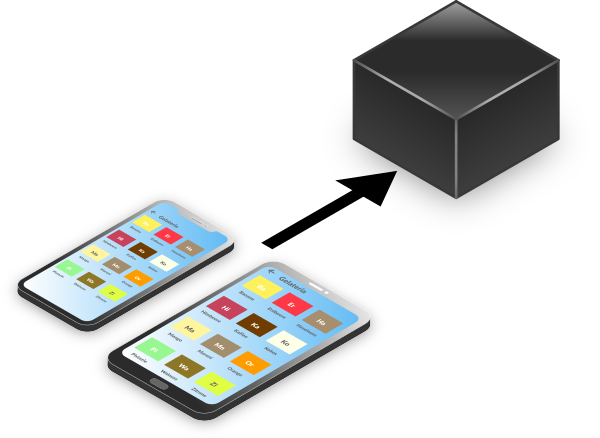

In normal, day-to-day use, you, the integrator and your customer, the end-user, should treat the system as a 'black box'.

In day-to-day use, the TSS is simply a 'black box'

In day-to-day use, the TSS is simply a 'black box'

Before diving deeper into further topics, we want to highlight each others' responsibilities.

Taxpayer's responsibilities

The end-user must:

- Have an ERS, including a TSS, attached to their account;

- Be able to deliver TSS exports to the financial auditors within reasonable time frames (usually either live, within 24 hours or even up to some days);

- Be able to deliver DSFinV-K exports - a detailed report containing all transaction details and some master-data. Those are generated in a daily-closings / shift-end report;

- Ensure that its fiscally relevant data is backed up accordingly. It is recommended to store at least two backups in different physical locations. Usually the end-user already takes care of this with their respective tax-advisor. In Germany tax-payers need to store their data for between 10-30 years.

Regular backups should be stored both on-site and off-site

Regular backups should be stored both on-site and off-site

PoS-Vendor's responsibilities

In order to operate in the German market, PoS vendors need to integrate a TSS in their ERS. In the long-term, this will ensure that there will no PoS systems without a TSS in place.

fiskaly's responsibilities

Our foremost responsibility is the delivery and operation of the TSS for you and your customers.

Though not being a direct legal requirement, it is a fiskaly quality requirement to ourselves that we continuously improve our systems and deliver software updates. Software updates to the TSS are provided by fiskaly. The system integrator / PoS vendor will be informed about updates via changelogs or by the developer newsletter - sign up using the form at the end of this page!

All necessary software updates are provided free of charge.